In an industry crowded with payment platforms, each promising faster settlements, broader coverage, and sleek interfaces, Lemonade Payments refuses to blend into the noise. It positions itself not merely as another processor in the fintech marketplace, but as a privacy-driven, enterprise-grade engine engineered to fuel sustainable business growth across Africa.

Where competitors often chase headlines with flashy features or token launches, Lemonade takes a quieter, more deliberate route, anchoring its value proposition in trust, operational speed, and modular scalability. This is not about payments as a commodity; it’s about re-architecting the very fabric of how companies, and their customers, interact financially.

By stripping away unnecessary data exposure, giving businesses the tools to move money securely across borders, and ensuring integrations that scale as companies grow, Lemonade is challenging entrenched norms in the African payments sector. In doing so, it’s not just offering a service, it’s building the kind of infrastructure that allows businesses to operate with confidence, compliance, and a long-term growth horizon.

Founded in 2023 by finance veterans Mark and Andrew, Lemonade Payments was born out of frustration with the status quo. Both had worked in banking and payments long enough to witness recurring industry failings, customer harassment from leaked details, spam targeting, and reputational damage from insecure payment flows.

The founders’ response was decisive: create a system that processes payments without compromising user data. Lemonade was built from the ground up as a white-label, API-first payment platform that serves businesses, not end-users directly, giving brands full control over customer experience while Lemonade powers the back-end.

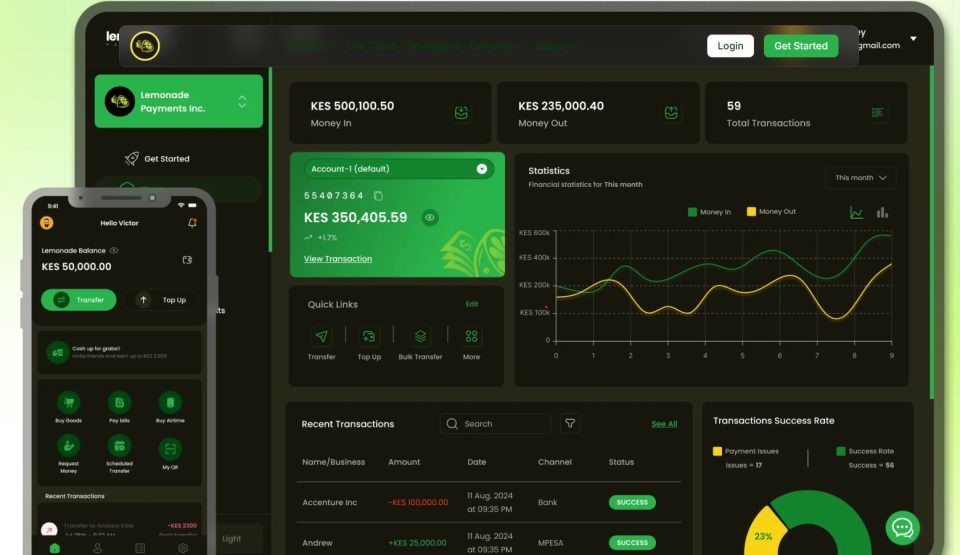

Modular, Scalable, and Enterprise-Ready Feature Suite

Lemonade’s platform is a modular toolkit, enabling businesses to deploy only what they need while scaling on demand.

Core Services

- Pay-In Solutions: Accept payments via virtual accounts, payment links, cards, mobile money, and bank transfers in 40+ currencies, including USD, GBP, EUR, NGN, KES, and GHS.

- Transfers: Automate cross-currency and same-currency payouts to over 150 countries, supporting SWIFT, SEPA, CHAPS, NIP, and more—with no hidden fees.

- Banking-as-a-Service: Multi-currency accounts, treasury features, and advanced payment orchestration tools via a single API.

- Operational Tools: Bill payments with in-app approval workflows, reminders, and searchable archives. Invoicing, virtual cards, and identity verification are in the pipeline.

- Developer Experience: Full API documentation, automation tools, OAuth authentication, and IP whitelisting for added security.

Boasting 99.95% uptime, Lemonade ships weekly feature updates and supports both online and offline businesses. The five-minute onboarding process is a clear nod to its user-centric engineering.

Values That Shape the Product

Lemonade’s ethos isn’t optional window dressing—it’s the backbone of every strategic decision. Guided by values such as care, transparency, curiosity, customer obsession, ownership, and authenticity, they’ve sculpted a culture that delivers in action, not just rhetoric. A team united by these principles has built what they’re calling the “payments experience reimagined,” blending a white-label, blockchain-powered digital wallet with a privacy-first framework that preserves user data and exudes trust.

More than slogans, these values manifest in customer delight and collaboration. As they say: “With the right platform, great things can happen.” The phrase isn’t just aspirational, it reflects their belief in responsibility and care as the engines of innovation.

Adoption & Market Reach

Lemonade’s infrastructure isn’t theoretical, it’s proving its mettle across Africa:

- Sectoral Spread: Adoption spans e-commerce, fintech, travel, hospitality, payroll, consulting, and more—showing versatility and relevance across industries.

- Real-World Impact:

- XYZ Store uses Lemonade to streamline payments from customers, vendors, and delivery staff,

- cutting friction and errors.

- ABC Construction relies on the platform for payroll distribution—ensuring that workers, whether paid hourly or monthly, receive timely, hassle-free disbursements via bank transfers or Lemonade Wallets

Geographic Footprint: Supports operations across more than 20 African countries, with transfers reaching 150+ global destinations.

- Support Model: Each integration is backed by dedicated account and technical managers, complemented by responsive onboarding and support teams.

Regulatory Standing & Compliance

In fintech, credibility isn’t optional, it’s foundational. Lemonade nails this by operating through officially licensed banks regulated by the Central Bank of Kenya, ensuring legal adherence without compromising speed or functionality.

On the support front, transparency is mandatory. Lemonade offers direct, customer-first support channels, including, email, phone, and in-platform chat, backed by intuitive real-time transaction status updates.

Together, this means business leaders can count on a platform that is both secure and dependable, one that delivers operational confidence alongside regulatory peace of mind.

Tokenomics: Setting the Record Straight

Unlike many fintech startups entering the Web3 space, Lemonade has no token economy. There is no ICO, governance token, staking program, or speculative asset tied to its operations. This keeps its focus firmly on delivering robust, compliant B2B payments infrastructure, avoiding the volatility and regulatory scrutiny often associated with token launches.

Roadmap

| Live | Coming Soon | Future Goals |

| Pay-In solutions, Transfers, Bill Payments, Banking-as-a-Service, Analytics dashboards, API integration | Virtual cards, Invoicing, Identity verification | Expanded financial operations, deeper fintech integrations |

While the roadmap is functionally visible on the platform, there are no public release dates.

Wins & Achievements

- 50+ integrations across multiple industries

- 99.95% uptime with weekly feature releases

- Positive testimonials from founders like Henry Ohanga (Code Particles), citing Lemonade’s reliable bulk settlement and payroll systems

- Growing footprint in cross-border payments, expanding African business reach into global markets

Lemonade is emerging as one of the most principled players in Africa’s fintech space. By focusing on privacy as a default, scalability as a necessity, and trust as a currency, it’s positioning itself for long-term relevance in a competitive market.

If it pairs its operational discipline with more public proof points, roadmaps, client showcases, and ecosystem incentives, it could move from being a quiet disruptor to a household name in African business infrastructure.

Lemonade Payments appears to be a deliberate, trust-focused infrastructure reshaping how African enterprises handle money movement. With its privacy-first approach, technical agility, and growing adoption, Lemonade is not chasing hype, it’s building foundations. And in fintech, strong foundations always outlast the noise.