Bitcoin traders are pricing in higher volatility into June and July, defying the usual summer slowdown, analysts say.

Crypto traders might want to cancel their summer vacations as options markets are flashing signs that the coming months could be anything but quiet. Despite the season’s reputation for sluggish activity, where both crypto and equities often cool off, current data suggests the market might be in for a hotter, more volatile stretch, Kaiko’s analysts say.

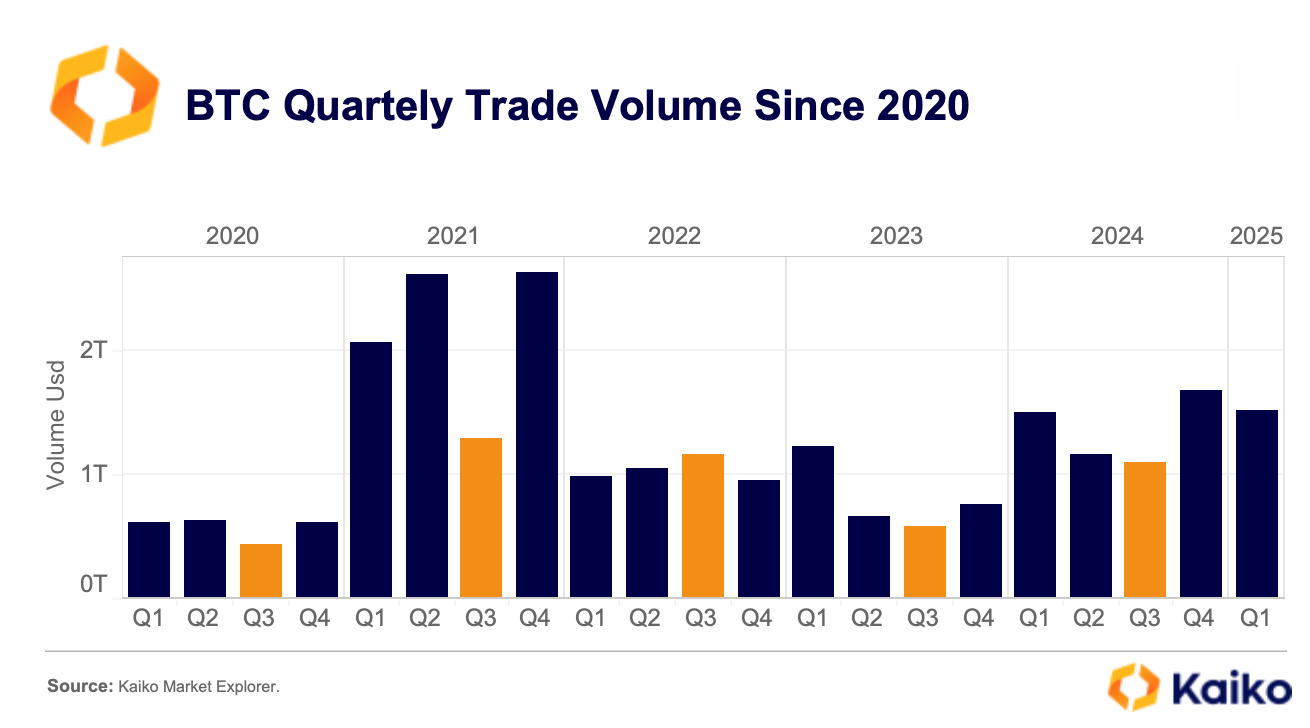

In a recent research note, the analysts pointed out that since 2020, Bitcoin (BTC) has regularly seen its lowest trading volumes during the third quarter — peak summer months — except in 2022, when a wave of bankruptcies, including Celsius Network and Three Arrows Capital, sent markets into turmoil.

The data shows that “options markets are already pricing in higher volatility,” a clear signal that something unusual may be on the horizon. In particular, June 27 expiry options have seen a spike in volume, with bullish bets targeting eye-catching strike prices of $110,000 and $120,000. These positions suggest some traders expect Bitcoin to reach new highs, even as macroeconomic uncertainty lingers.

Several catalysts are converging to stir up market expectations. The Federal Reserve’s upcoming meeting could impact broader financial conditions, while former President Trump’s July 9 tariff deadline introduces added geopolitical risk, the analysts say. At the same time, major U.S. crypto legislation is anticipated before Congress breaks for its August recess, adding further uncertainty to the months ahead.

Traditionally, summer brings a cooldown. Stock trading volume in August tends to drop significantly. Crypto often follows suit, with on-chain and exchange volumes typically slumping in August. For instance, spot trading fell by nearly 20% in August 2023, and total exchange volume dropped by over 11%, according to market data.