Bitcoin’s downside pressure has seen sell-off dynamics shift from newer coins to older cohorts, with the gradual capitulation coming amid broader market weakness.

On-chain metrics and data insights platform Glassnode says Bitcoin (BTC) Bitcoin’s downside pressure has seen sell-off dynamics shift from newer coins to older cohorts, with the gradual capitulation coming amid broader market weakness.

Year-to-date, BTC has dropped more than 17%, including a 9% decline in the past week. Tariffs and broader economic uncertainty have weighed heavily on risk assets, including Bitcoin.

With this performance, coins in the three to six months cohort have seen share of realized losses rise to more than 19%. It only stood at about 0.8% on Feb. 27 before bear market sentiment hit.

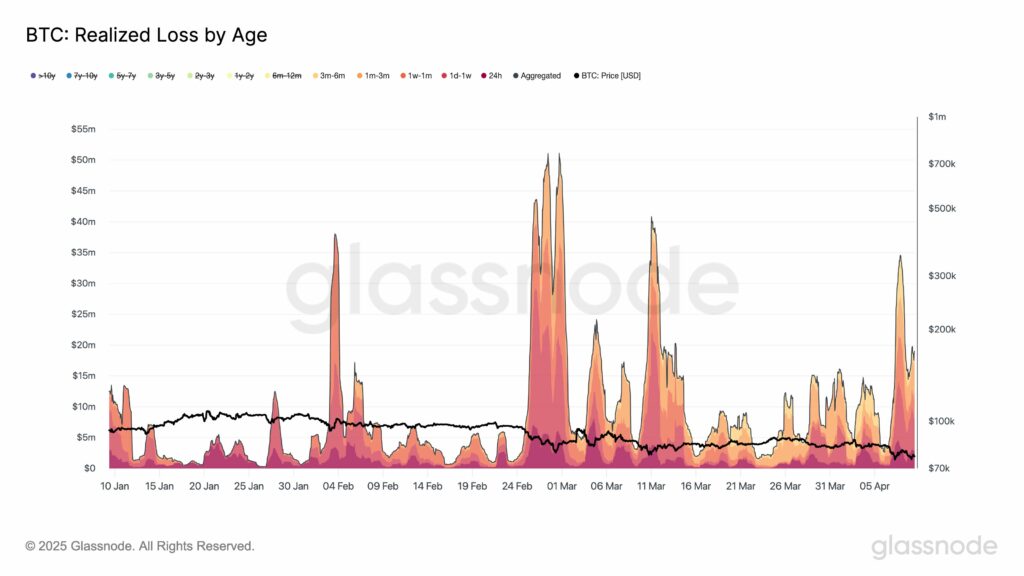

“In comparison to previous large Bitcoin sell-offs YTD, losses are now spreading to older coins – especially in the 3m–6m group, whose share in loss realization jumped from 0.8% to 19.4% of total losses since Feb 27,” Glassnode posted on X.

A chart the platform shared shows the BTC realized loss by age metric spiking sharply in April.

Younger coins – in the one week to one month and one month to three months age accounted for more than 50% of total realized losses as February came to a close.

However, while the 3m–6m cohort then represented less than 1% of total losses, the trend has since reversed, with this group now accounting for a significantly larger share.

This shift intensified as BTC price declined from above $86,000 in late February. A retest of support below $75,000 in March accelerated the move toward capitulation for the 3m–6m holders. By March 11, the 1m–3m group’s share of losses had dropped to about 16.3%, while that of the 3m–6m cohort rose to 4.9%.

https://twitter.com/glassnode/status/1909965122090553428

Despite total BTC losses falling to roughly $41 million, Glassnode’s on-chain data shows older cohorts are undergoing a “gradual broadening of capitulation.” As of early April, the 1w–1m and 3m–6m cohorts were each responsible for around 19% of realized losses.

“This marks a structural shift in loss realization and points to sustained pressure on mid-term holders,” the analysts noted.

Bitcoin is down 2% in the past 24 hours.