Cardano price continued to consolidate this week, but the ongoing whale accumulation and its technical pattern points to a rebound.

Cardano (ADA), the popular layer-1 network, was trading at $0.70 on Saturday, a level it has remained at in the past few days.

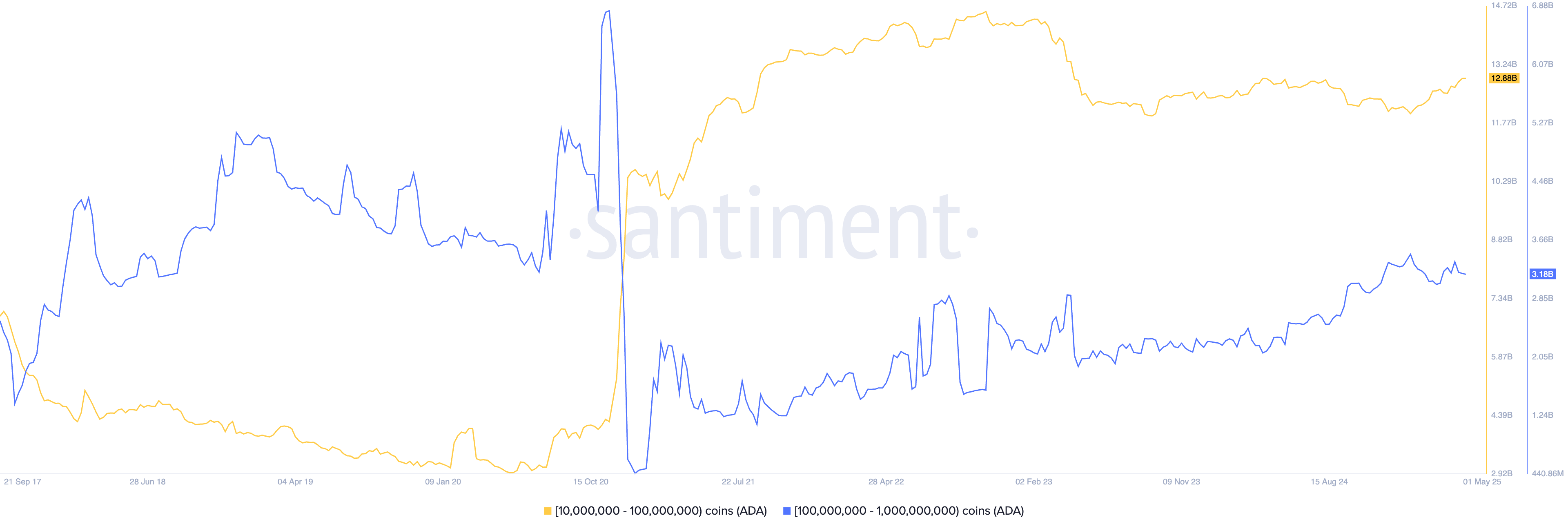

There are signs that whales are starting to accumulate as they expect the price to rebound in the coming weeks. Santiment data shows that the amount of ADA coins held by whales with between 10 million and 100 million coins has jumped to 12.8 billion, up from 12 billion in January.

Similarly, whales holdin between 100 million and 1 billion coins have boosted their holdings to 3.14 billion from 2.6 billion in March. This accumulation trend may continue as sentiment in the crypto industry improves.

Retail and whale demand is also visible in staking data. According to StakingRewards, investors have added 307 million ADA tokens worth $215 million in the last 30 days.

There are three main potential reasons for this accumulation. First, market participants expect that Bitcoin (BTC) price will keep rising, with Standard Chartered seeing it hitting $200,000 in Q4. A strong Bitcoin surge often leads to more altcoin gains.

Second, there are signs that the SEC, under Paul Atkins, will approve spot Cardano ETF, a move that may lead to more institutional demand. This demand will be much higher if the SEC allows these ETFs to offer staking features.

Third, there are hopes that Cardano’s integration with Bitcoin will help to supercharge its assets in the decentralized finance industry. This integration will help Bitcoin holders to generate a monthly return.

Cardano price technical analysis

The daily chart shows that ADA price has held steady at a crucial resistance level in the past few days. It is consolidating at the 50-day and 100-day Exponential Moving Averages (EMA).

The coin is also hovering slightly below the upper side of the falling wedge chart pattern. A wedge happens when there are two descending and converging trendlines. It often leads to a strong bullish breakout over time.

Such a move would push Cardano price to $1.176, the neckline of the double-bottom pattern at $0.513. A double bottom is also one of the top bullish signs in the market.