Introduction

Blockchain technology has come a long way since Bitcoin introduced the world to decentralised payments in 2009. What started as a tool for peer-to-peer transactions has evolved into a massive ecosystem powering finance, gaming, supply chains, and even decentralised physical infrastructure (DePIN).

Today, the conversation isn’t just about Bitcoin or Ethereum. Hundreds of blockchains now compete for speed, scalability, and real-world adoption. In this article, we’ll explore five blockchains that are growing the fastest, based on adoption, developer activity, transaction volume, and market relevance.

1. Ethereum (ETH)

Ethereum remains the foundational blockchain of the smart contract era. Since its 2015 launch and the 2022 transition to proof‑of‑stake (“The Merge”), it has reduced energy usage by over 99% and established itself as the DeFi, NFTs, and Layer‑2 innovation hub.

Ethereum is growing due to major upgrades like Dencun in March 2024 (which implemented proto‑Danksharding) and the Pectra update in mid‑2025, improving staking flexibility and gas efficiency. Its Layer‑2 ecosystem, led by Arbitrum, Optimism, and Base, continues to expand throughput and reduce costs, lifting developer activity and broadening mainstream access.

About tens of thousands of dApps run on Ethereum, from DeFi platforms like Aave, Curve, and MakerDAO, to NFT marketplaces and enterprise use cases. Annual developer events, hackathons, and launchpads feed steady project inflows. Institutional investment in Ethereum ETFs and staking infrastructure is further accelerating its adoption.

Opportunities on Ethereum include staking rewards (~3–4% annual yield), developer roles, and tokenisation across assets and industries. The ecosystem remains resilient and fastest growing by sheer scale and developer traction, not flashy, but foundational.

At the time of writing, Ethereum( ETH) trades around $3,628, with a market cap of nearly $402 billion and over 60% share of total DeFi TVL, estimated at around $78 billion.

2. Solana (SOL)

Solana’s standout feature is its high throughput and low-cost transactions, powered by Proof of History (PoH) consensus. Its network handles up to 65,000 transactions per second (TPS) in peak benchmarks but consistently delivers ~1,200 TPS in real-world use, with sub‑$0.01 fees. As of late 2024, its market cap reached $105 billion, making it one of the fastest-growing L1 blockchains.

Solana’s rapid growth is fueled by explosive DeFi and NFT volume. Locked SOL in DeFi climbed to 50 million (~8.4% of supply), and DEX trading topped $355 billion in January 2025, nearly doubling from the prior year. Raydium, Jupiter, and KaminoFinance led this growth, with memecoin trading surging alongside it.

Developer activity is intense: Q3 2024 saw over 130 product launches at SolanaConf and 29 projects raising $173 million. DePIN (real-world infrastructure on blockchain) is gaining traction, with energy and telecom infrastructure projects emerging on-chain.

With a market cap of $90Billion, Solana currently trades at $167 per token.

Opportunities include NFT marketplaces like Magic Eden, DeFi protocols (Serum, Raydium), DePIN integrations, and upcoming upgrades, Firedancer targets scalability to 1 million TPS. Solana’s growth is performance-driven, catching attention with real use cases and developer buzz.

3. Avalanche (AVAX)

Avalanche offers a unique multi-chain architecture with its X‑Chain, C‑Chain and P‑Chain, enabling custom subnets for faster processing, lower fees, and tailored application environments. Launched in September 2020, Avalanche has carved a niche for enterprise-ready dApps, asset tokenisation, and high-throughput finance.

In December 2024 it raised $250 million for the Avalanche9000 upgrade, which slashes subnet deployment costs by up to 99%. Partnerships with AWS, Deloitte, and Passolig (Turkey’s major ticketing provider) highlight its institutional-grade usage.

Projects on Avalanche span from real-world asset tokenisation, bond issuance, carbon credits, sports ticketing, to subnets for gaming and private enterprise chains. Developer tools are robust and designed for teams needing flexibility without sacrificing security.

Opportunities include building enterprise dApps or security tokens; subnet creation for private or public use; and DevOps roles in the Avalanche ecosystem. While its market cap (~$9billion) is smaller than Ethereum or Solana, its architectural uniqueness and strategic partners suggest increased growth.

4. XRP Ledger (XRP)

The XRP Ledger is engineered for fast, low-cost settlement, targeting global cross-border payments and remittance flows. It settles transactions in seconds with minimal fees, making it attractive for financial institutions and merchants.

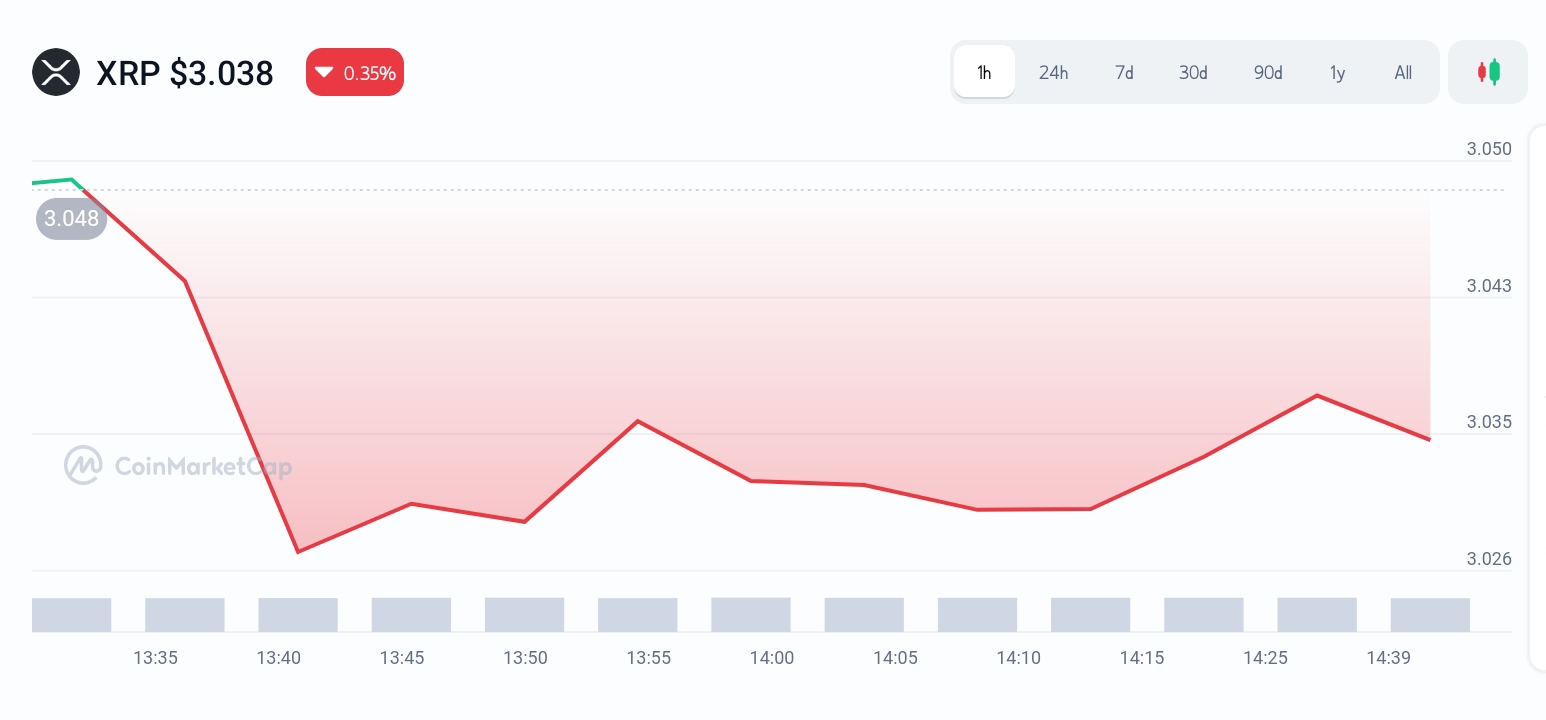

XRP’s token trades at around $3.03, with a market cap of approximately $179.9 billion. The project saw renewed momentum as legal clarity and regulatory updates in the U.S. and other jurisdictions encouraged renewed institutional adoption.

Its growth comes from renewed bank and remittance partnerships; RippleNet continues to expand in Asia, Latin America, and Africa, positioning XRP as an alternative to legacy systems like SWIFT. Demand is grounded more in utility than speculation.

Opportunities are in cross-border payments, remittance corridors, and compliance-based digital settlement networks. Developers building rails for fiat-crypto interchange, liquidity utilities, and global settlement infrastructures find real-world traction here.

5. Sei Network (SEI)

Sei Network is a niche Layer‑1 blockchain purpose-built for trading and DeFi infrastructure. It delivers sub‑400 ms finality and has demonstrated ~250K TPS in internal testing, making it specially suited for high-frequency order books and DEXs.

At roughly $0.29 per token and a market cap near $1.7 million, Sei is a smaller ecosystem but rapidly growing with 38% month-over-month TVL gains in mid‑2025. Its focus is frictionless trading performance rather than generalised dApp provisioning.

Projects on Sei include order book DEXs, liquidity mining programs, and decentralised derivatives. It’s gaining institutional attention as a trading infrastructure alternative to slower general-purpose chains.

Opportunities revolve around developing high-throughput trading platforms, DEX creation, liquidity provision, and integrations with custodial or institutional wallets. Sei’s traction is technical and niche, but meaningful.

Final Thoughts

These five blockchains exemplify different growth trajectories and areas of innovation

Each one is a legitimate, well-established project (or rapidly growing) with measurable adoption and clear use cases. From scalability and speed to real-world integration and financial utility, these innovations are shaping the next phase of digital infrastructure.

What’s clear is that growth in this space is not just about technology; it’s about adoption, interoperability, and the ability to deliver real value across industries.