PayShap enable real time payments between users of different banks in South Africa (image source: BitCoin KE)

The first time Nomsa Dlamini* was asked to send some money to her friend via PayShap, her immediate response was no. She explained that the payment system was often difficult to find on the bank app, and she would rather send funds through the instant transfer channel.

“But she activated it for me, and I ended up using it. Like I said, the banks are also reluctant. They won’t make it that easy for you to find because they want to make money,” Dlamini, who is familiar with South Africa’s banking system, tells Techpoint Africa.

When PayShap launched in March 2023, it was designed to be an instant payment system and a solution to South Africa’s need for low-cost immediate inter-bank payments that would replace the usual 24 to 48-hour transaction delay.

The South African Reserve Bank (SARB), as part of its National Payment System Framework and Strategy Vision 2025, proposed an instant payment system that would enhance financial inclusion for the underbanked. This led to the creation of PayShap.

The idea was simple: PayShap, built into bank apps, would let users send money instantly and with low rates up to R3,000 (about $165) without needing bank details. Users would register with their phone numbers, which would become the ShapID. The idea was to slowly phase out cash or at least limit it to small everyday transactions — like taxi fares, haircuts, or informal market transactions.

Theoretically, it could help turn South Africa’s cash-heavy economy into a more digital one. However, two years after its launch, PayShap has not seen the kind of adoption it was expected to have.

Most South Africans still pay cash for transactions. South Africa’s BankservAfrica asserts that nine out of ten transactions in South Africa are done in cash.

Kganya Molefe, a former Payments Product Manager at J.P. Morgan and an early adopter of PayShap, said in a LinkedIn post that because of the lack of awareness within her community, she spent more time explaining what PayShap was than using it.

Despite being built into the major banks’ apps, PayShap is still practically unknown to most people. And without awareness, its uptake has been slow.

Join 30,000 other smart people like you

Get our fun 5-minute roundup of happenings in African and global tech, directly in your inbox every weekday, hours before everyone else.

Why PayShap is not catching on

The SARB’s rollout of PayShap did not generate as much awareness as it could have. Molefe suggests that because the system went live with only four of South Africa’s banks — Absa, Standard Bank, Nedbank, and FNB — it did not reach as many people as it should have.

Although it is safe to say that considering the four banks the system launched with are four of the country’s biggest, accounting for a significant percentage of the banked population in South Africa, a lack of awareness should not be its biggest problem.

Dlamini tells Techpoint Africa, “It hasn’t become the first channel that everyone uses, and I think that’s also based on marketing, because it was only last week or so, I started to see boards of PayShap around Pretoria. But I was like, this thing’s been [around] for two years, and it’s meant to be a national payment system.”

In addition, at launch, banks kept charging high fees on PayShap transfers even though it was built to be a low-cost option. For instance, a PayShap transfer between different banks initially cost more than an EFT (Electronic Funds Transfer), which would typically take between 24 and 48 hours.

Analysts point out that PayShap fees ranged from about R10 to R49 per transaction, depending on the bank and transaction amount, while standard EFTs cost only R1 to R2. In short, “existing EFTs seem to be cheaper for consumers than PayShap.”

With these rates, users were unlikely to choose PayShap unless they urgently needed instant fund transfers.

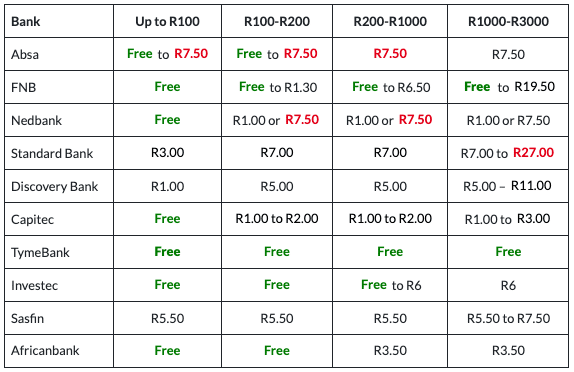

Now, PayShap fees have been regulated and made cheaper.

Source: BusinessTech

But even after the fees had been resolved, PayShap’s potential revenue threat for banks that already have instant payment options at higher costs could continue to be a barrier to its adoption. Dlamini tells Techpoint Africa that South African banks weren’t keen on the system.

“I think the way it was rolled out goes back to the fact that the four big banks weren’t keen on it. Because they would lose revenue since they already had instant channels. If they are moving to PayShap, they can’t charge for instant payments.”

In addition, the PayShap feature was hard to find on the bank apps. It would probably remain unnoticed if you didn’t know it was there. Some banks, like Tymebank, included pop-ups to inform users of the service. Once users logged into the app, they would get a pop-up asking, “Do you want to activate your PayShap ID?” For some other banks, users would have to search for the system.

The absence of ease of use leads to many missed opportunities for PayShap.

Molefe writes, “Over the past year, I’ve suggested using PayShap for my hair appointments on at least three occasions, but it hasn’t been taken up. We both bank with the same institution, so instant payments aren’t necessary because banks usually reflect book transfers immediately. Regardless, she prefers and insists on using cash.”

Behind all these, many South Africans don’t know that PayShap exists, and those who know don’t want to go through the trouble of activating it. Moreover, low-income earners in South Africa already have the CashSend/e-wallet system, with which they can receive and access cash without a bank app; hence, there is a lack of urgency in adopting PayShap.

But word of mouth continues to be PayShap’s biggest advocate. As more people discover and suggest it, it will likely become more commonplace among South Africans.

“If my friend had not activated it that day, I possibly still wouldn’t have a PayShap ID to this day. And that’s how I also introduced my hairdresser to it. I was like, ‘Do you really always want to go to the ATM when I can deposit into your account? Do you have PayShap?’ It took us a couple of minutes to find the PayShap activation on the FNB app, but I activated her account. So now, whenever I do my hair, I just PayShap her,” Dlamini says.

Fortune McCane adds that Payshap saw an uptick in adoption between 2024 and 2025, but mostly among younger people because they understand it better.

For now, most South Africans still stick with cash and bank cards for transactions.